Easy kilometre registration

In the post-Coronavirus world, your best bet as a company is to find a simple kilometre registration system for your employees.

Our tip? Choose one that also takes your employees who cycle into account, because it is clear that the classic two-wheeler is set to gain considerably in popularity.

Studies in various cities have already shown that the bike is the only means of transport that actually has an increasing number of users. Cities are therefore investing heavily in cycling paths and safety for cyclists.

Published 16th of May 2020

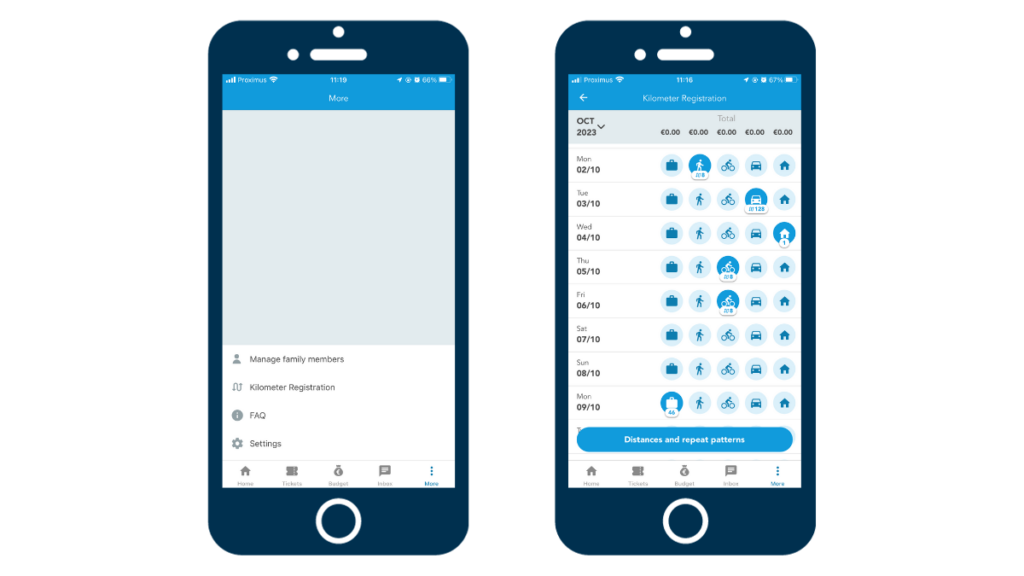

Easy kilometre registration with the Olympus app

If you use the Olympus Mobility platform, administration is no longer a burden. Our platform and the Olympus app provide an efficient solution to the administrative complexity of mobility.

How? By providing a simple kilometre registration and corresponding mileage allowance for each employee. The employee digitally registers both their commute and business trips in the Olympus app. Even working from home is an option.

At the end of the month, the employer receives a report with the total amount of the kilometric allowance per employee. It couldn’t be easier.

When is a kilometre allowance allowed?

A kilometre allowance is allowed for both bikes and private cars.

1. Commuting by bike

Is a kilometre allowance provided on sector or company level? Then, as an employer, you can pay your employees a bike allowance.

- You can reclaim 100% of the bike allowance per kilometre up to a certain amount as deductible business expenses. The bike allowance is exempt from social security contributions.

- The maximum amount is EUR 0.27 per kilometre, which is indexed and adjusted annually on 1 January. From 2024, the maximum bike allowance is EUR 0.35 per kilometre.

- If you, as the employer, grant the maximum fixed cost that is also paid by the government, you are not required to submit any supporting documents.

2. Commuting by private car

If your employee commutes to work using private transport (car, motorcycle, motorbike, etc.), the law does not provide for an obligatory employer’s contribution. If this is provided for in a sectoral collective agreement, the employer is obliged to provide an allowance.

An example is the sociocultural sector (PC 329.01): if an employee commutes by private car, the employer has 2 options:

- If the employee has to travel a minimum of 5 kilometres, the employer must reimburse 60% of the price of a train ticket for the same distance.

- The employer can also choose to pay a mileage allowance of up to € 0,4237 per kilometer. This may not be advantageous for the employee, as he or she can only receive €430 tax-free commuting allowance in the case of a cost flat rate. Anything over and above that €430 will be taxed as wages.

Good to know:

- Some sectors operate their own scales based on the number of kilometres travelled.

- Other sectors apply a reimbursement based on scales for the use of public transport.

- Some sectors also reimburse travel from a minimum distance to be covered.

In the post-Coronavirus era, commuting by car is certainly reduced. Factors contributing to this are working part-time, working from home, and the increasing number of journeys made by bike. As an employer, you can optimise the commuting allowance by paying it only for the days when commuting actually takes place. The Olympus app provides a user-friendly and efficient solution.

Easy kilometre registration with the Olympus app, including cyclists

The Olympus app makes kilometre registration very easy.

- The employer sets the commuting distance and thereby the kilometre allowance in the Olympus management portal. They do so per employee, both for journeys made by bike and for journeys made by private car.

- The employee registers his/her journeys daily in the Olympus app. The employer can thereby optimise this cost in the event of illness, leave or part-time work.

- The employee can also track the total kilometres allowance in the Olympus app.

- At the end of the month, the employer receives a summary of the total allowance that should be paid to the employee.

3. Kilometre allowance for business travel

A mileage allowance can be paid both for journeys made in a private car and in a cafeteria car – a company car without a fuel card.

Business travel with a private car or cafeteria car

The rules to be followed are rather cumbersome. You can also pay your employee a kilometre allowance for business travel, even if they travel with their own car. The employee can choose between the fixed costs and actual costs. Keeping track of these actual costs requires constant vigilance.

- The fixed cost of the kilometres allowance is currently € 0.3707 and is adjusted annually on 1 July.

- The amount per kilometre is a maximum amount. The employer may choose to apply a lower amount per kilometre.

- If the employer grants the maximum fixed cost that is also paid by the government, the employer is not required to submit any supporting documents.

- The kilometres allowance for business travel is not taxable. No social security contributions are deducted from the allowance either.

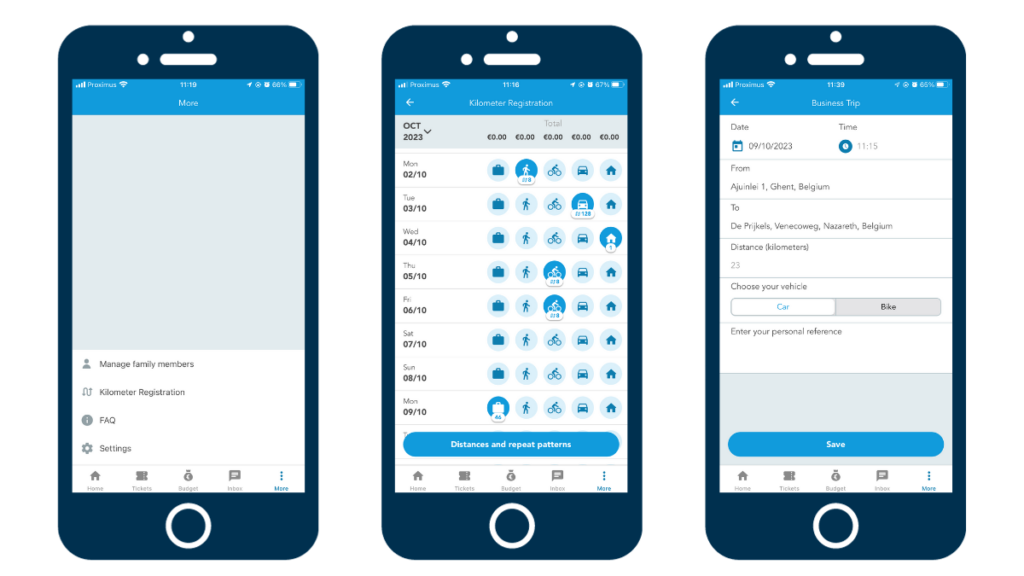

The Olympus app for easy kilometre registration

The Olympus app allows you to set a different rate for a cafeteria car without a fuel card and a private car.

- The employer provides the employee with access to the kilometre registration for business travel purposes.

- Business travel is then registered in the Olympus app, which is user-friendly and simple to use.

- After entering the place of departure and destination, the app automatically calculates the distance.

- At the end of the month, the employer receives a summary of the total allowance that should be paid to the employee.

One Mobility-tool to solve them all

In post-Coronavirus times, companies are confronted even more than before with the variability in the use of mobility by their employees.

- Each employee has his/her own mobility modes that differ individually.

- A cafeteria plan traditionally offers many choices.

- Some are now opting for a mobility budget, and that too is something else.

Olympus Mobility meets the demands made by companies to give their employees freedom of choice. Simultaneously, it wants to offer simplicity in handling the complex issue of mobility and provide companies with an improved insight into the true costs of all this.

Looking for a simple kilometre registration? With our Mobility tool, you are on the right track right away.

Would you like more information? Do not hesitate to contact us.