“Wait, how much does that car really cost us?”

Everyone who has ever worked with the mobility budget knows the moment all too well: “Wait, how much does that car really cost us?” Calculating the TCO, or Total Cost of Ownership, often turns out to be the most challenging part of the whole story.

Our colleague Bert Van Molle, Sales & Marketing Manager at Olympus Mobility, explains what TCO actually is, why it matters, and how to calculate it easily.

In short

For the legal mobility budget, there are two official TCO formulas. These calculate the total cost of the reference car and form the basis of the mobility budget an employee receives.

1. Actual costs formula

This formula starts from the average annual gross cost of the company car over the past four years (or for as long as the car has been in use).

You add up all actual costs: leasing or rental, insurance, maintenance, taxes (registration tax, road tax), non-deductible VAT, CO₂ solidarity contribution, fuel or electricity, and annual depreciation (usually 20%).

2. Flat-rate values formula

This formula uses a fixed and a variable component, depending on the type of car (leased or owned).

- The fixed component includes, among other things, the annual leasing cost or catalogue value, CO₂ contribution, and non-deductible costs.

- The variable component takes into account commuting distance, calculated using: (6,000 + commuting distance × 2 × 200) × cost per kilometre consumed.

There are online TCO tools that provide an indicative calculation for company cars. But for the mobility budget, these are not always sufficient: every company has specific cost items, policies, and fiscal agreements.

So seek guidance from a specialist or use the Olympus Mobility platform, which automatically applies the correct legal TCO rules per job category.

What is TCO?

TCO stands for Total Cost of Ownership, the total cost of owning or providing a car. It’s not just the leasing price, annual rental, or purchase value, but all costs incurred for as long as the car is in use. Think of fuel or electricity, maintenance, insurance, taxes, and even non-deductible VAT.

In other words: TCO shows what a car truly costs the company, not what it supposedly costs “on paper.”

Why is calculating TCO so important for the mobility budget?

Because the TCO forms the basis of the legal mobility budget. The government stipulates that the budget for a company car must be calculated based on the total annual cost of the reference car.

A correct TCO, therefore, ensures that the mobility budget is calculated realistically and in full legal compliance.

What is included in the TCO of a company car?

The TCO includes, among other things:

- Leasing or rental price of the car

- Fuel or electricity costs

- Insurance

- Maintenance and repairs

- Annual depreciation and residual value

- Road tax and registration tax

- Employer’s CO₂ solidarity contribution

- Non-deductible VAT and taxes on disallowed expenses

- Administrative costs for fuel or charging cards

- Possible costs for tyres, tolls, parking, or replacement vehicles

Some costs are directly visible on invoices, while others are “hidden” in leasing contracts or administrative fees. The most important thing is to be consistent: always use the same cost categories for all your calculations.

How to calculate the TCO

In Belgium, there are two official TCO formulas according to the legal mobility budget. Both start from the reference car.

1. The actual costs formula

This calculation is based on the average annual gross cost of the company car, calculated over the last four years (or for as long as the car has been in use).

You add up all actual costs: leasing, energy, insurance, maintenance, taxes, non-deductible VAT, and more.

2. The flat-rate values formula

Here you work with a fixed and a variable component, depending on the type of car.

For leased vehicles:

- TCO = fixed component + variable component

- Fixed component = annual rental or lease cost + CO₂ contribution + non-deductible VAT + vehicle costs

- Variable component = (6,000 + commuting distance × 2 × 200) × cost per kilometre consumed

For owned vehicles or financial leasing:

- TCO = fixed component + variable component

- Fixed component = catalogue value × 25% + CO₂ contribution + taxes

- Variable component = (6,000 + commuting distance × 2 × 200) × cost per kilometre consumed

Which formula should you choose as an employer?

The choice between the actual costs formula and the flat-rate values formula depends on how your organisation manages its vehicle costs.

- Do you use detailed data on leasing, maintenance and energy consumption? Then the actual costs formula is usually the best option: it provides an accurate picture of the total cost per vehicle.

- Do you prefer a simple, legally accepted calculation? Then you can use the flat-rate values formula, where fixed and variable components determine the total cost.

Important: you choose one formula for your entire company, and you are required to keep it for at least three years.

Want to switch to the other method afterwards? You can. You then use the new formula for every new employee who exchanges their company car. This keeps your mobility policy transparent, consistent, and legally aligned with the federal framework.

What are common mistakes when calculating TCO?

Four issues frequently appear in companies starting with the mobility budget:

1. Incomplete costs

Some items are forgotten, such as the CO₂ solidarity contribution, non-deductible VAT, or administrative fees hidden in the leasing contract. This results in a calculated TCO that is lower than reality.

2. Outdated data

Leasing contracts often run for three to four years, making older cost data unavoidable. This isn’t a problem as long as you use figures that remain representative of the current cost structure (e.g., energy prices or insurance premiums).

3. Double counting

Some costs are already included in the leasing invoice (such as maintenance or tyre replacement), but are unintentionally added again. This distorts the total cost.

4. Incorrect assumptions about the formula

Within a single company, you may use only one TCO formula — the actual costs formula, unless you explicitly choose the flat-rate values formula. Using both interchangeably leads to incorrect calculations.

And how does Olympus Mobility help calculate the mobility budget?

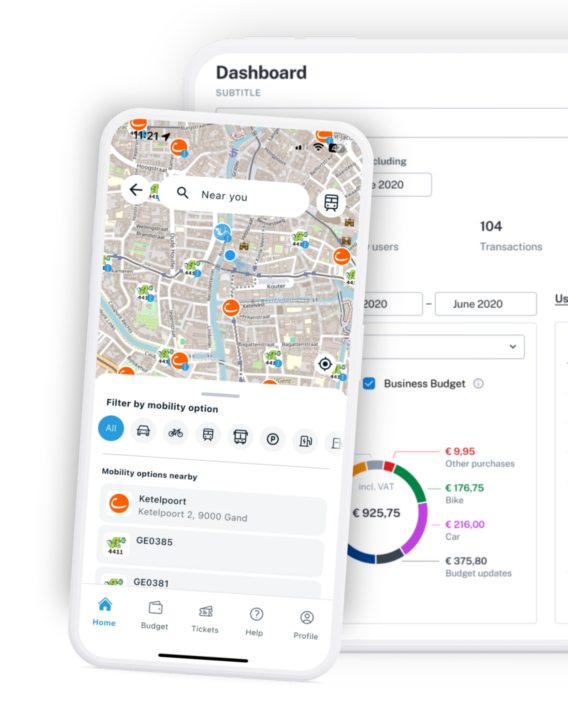

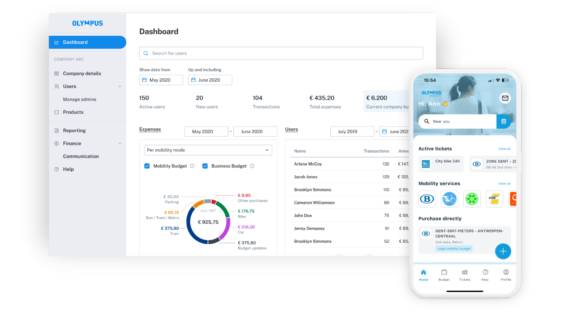

Olympus Mobility works with an ecosystem of specialised partners who help companies define and calculate the TCO for their reference vehicle. Once that calculation is in place, the Olympus Mobility platform takes over the administrative work.

In the Olympus management portal, you can instantly see:

- which mobility options are active,

- how much budget has already been used,

- and how much remains available for the employee.

This way, Olympus Mobility combines expert advice from reliable partners with practical management via one digital platform — from calculation to daily use.

Frequently Asked Questions about calculating TCO (FAQ)

1. How often should I recalculate the TCO?

Ideally, you should review the TCO annually, or whenever a cost factor changes — for example at the start of a new leasing cycle, rising energy prices, or changes in taxation.

For the mobility budget, such a revision is not only recommended but in practice also happens automatically through indexation.

2. How do CO₂ emissions impact the TCO?

Higher CO₂ emissions mean a higher CO₂ solidarity contribution and lower tax deductibility. Together, these two factors can increase the TCO by several thousand euros per year.

From 2026 onwards, fossil fuel vehicles will also lose their tax benefits entirely, making electric vehicles generally cheaper in terms of TCO.

However, this does not mean that employees with an electric car automatically receive a lower mobility budget. Companies that work with mobility budgets by job category use a reference car per function. This keeps the mobility policy fair and consistent, regardless of the type of car an employee chooses.

Conclusion

Calculating the TCO is not just a numbers exercise: it is the foundation for a fair, legally compliant and fiscally correct mobility policy.

Choose one formula, apply it consistently, and use the Olympus Mobility platform to manage everything automatically.

From 2026 onwards, the mobility budget will become mandatory for companies that offer company cars. Those who already start today with a correct TCO approach will be ready for that transition. This keeps your organisation legally compliant and gives employees the freedom of choice that comes with a future-proof mobility policy.

Want to discover everything about the federal mobility budget?

From eligibility criteria to practical use: learn how the mobility budget functions and how to leverage it for sustainable mobility.