Step 0. Calculate the mobility budget based on the Total Cost of Ownership.

The Total Cost of Ownership of the current company car determines your employee’s mobility budget.

This TCO includes, among other things …

- The monthly lease or rental price of the company car

- Fuel costs

- Insurance

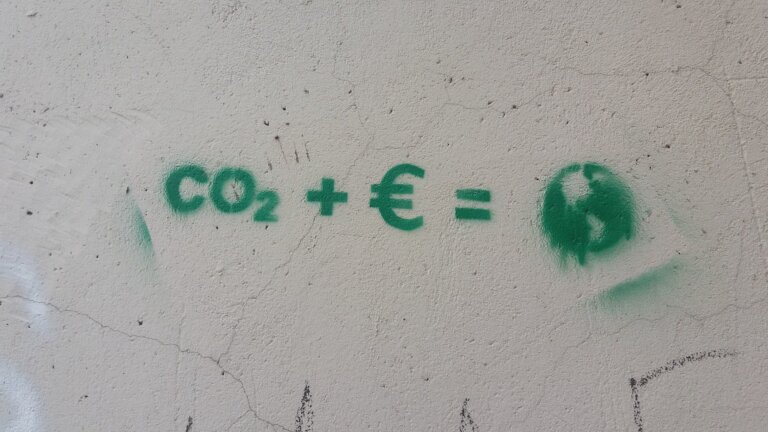

- CO2 solidarity contribution

- Non-deductible VAT

- Corporation tax on non-deductible car costs

- …